Student Loans

Borrow Responsibly

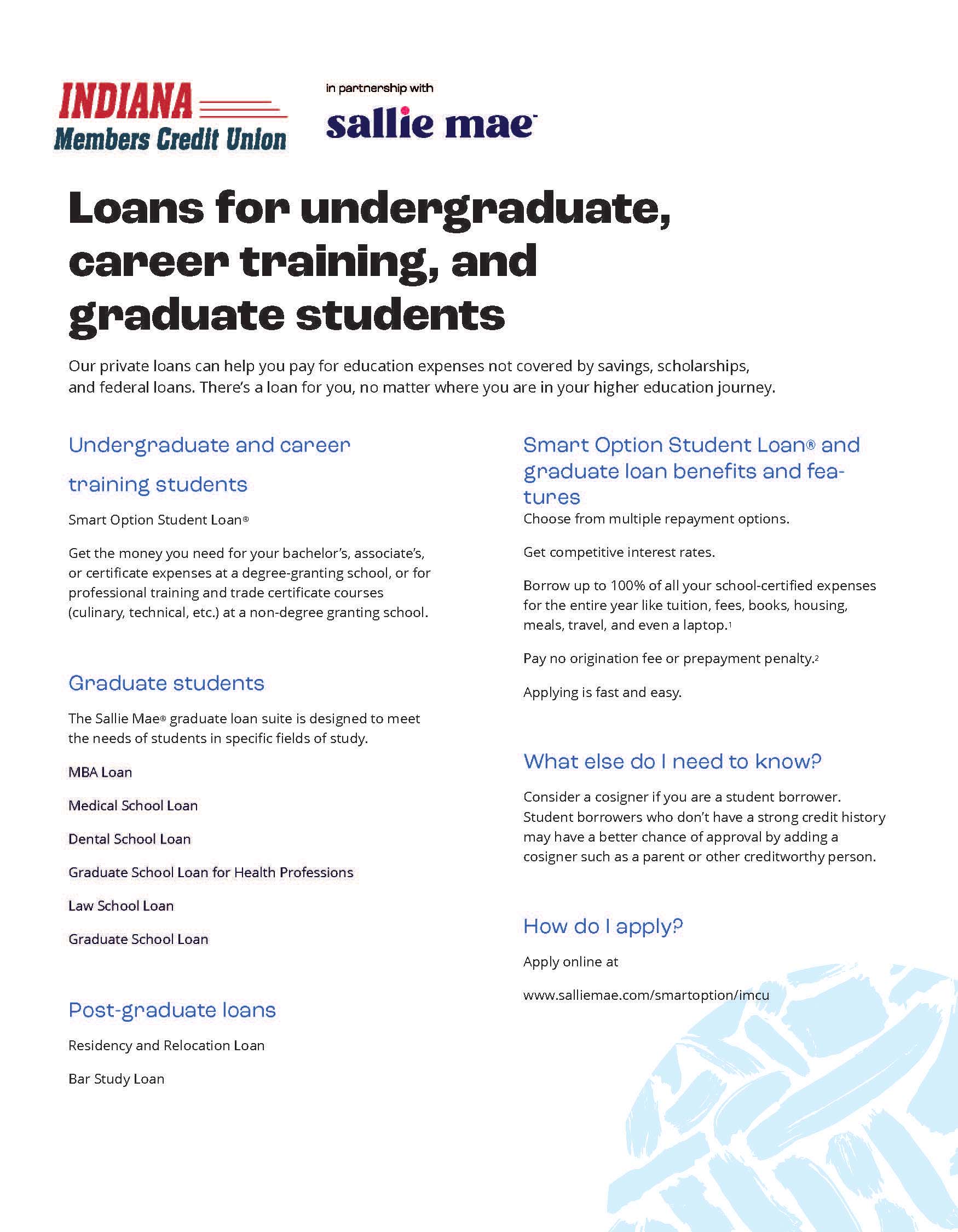

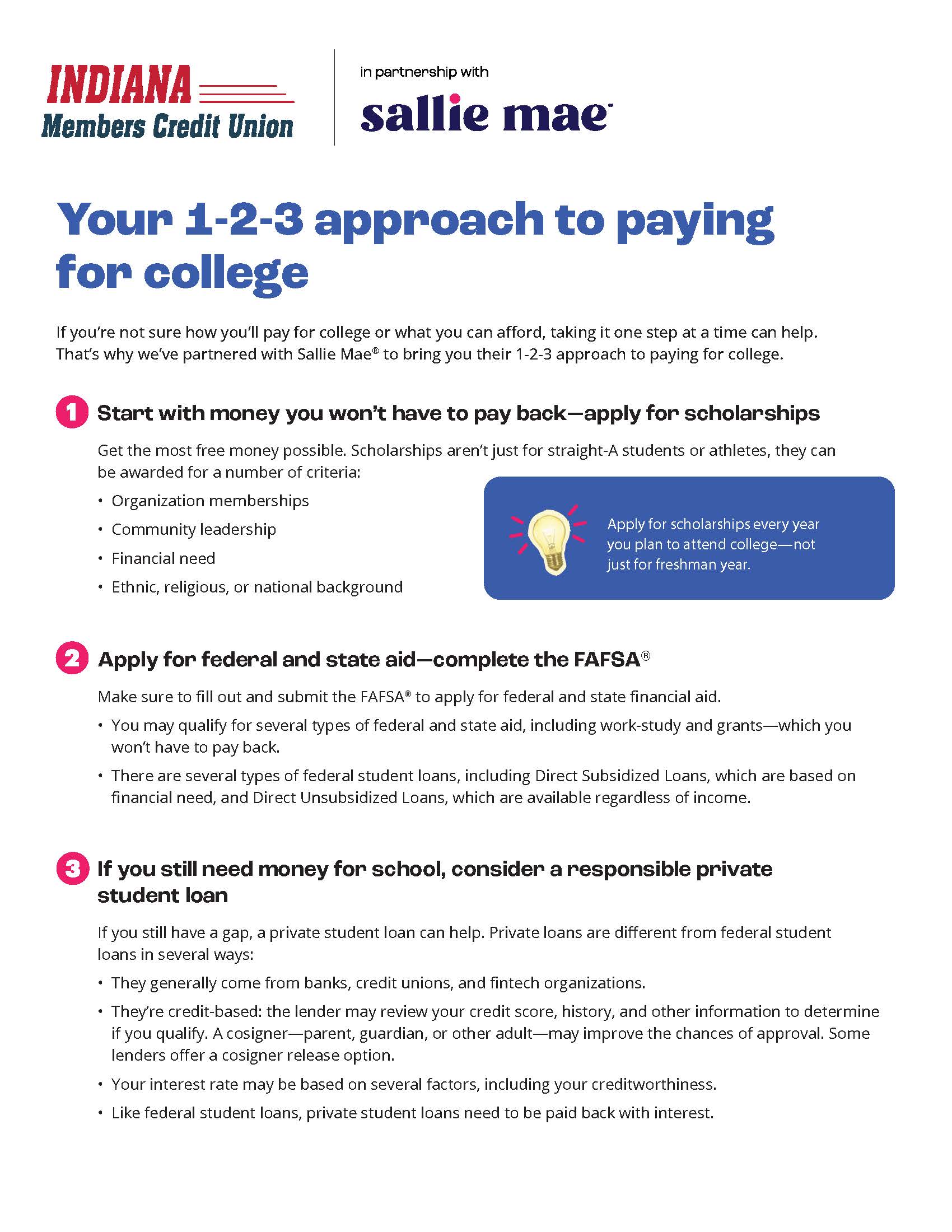

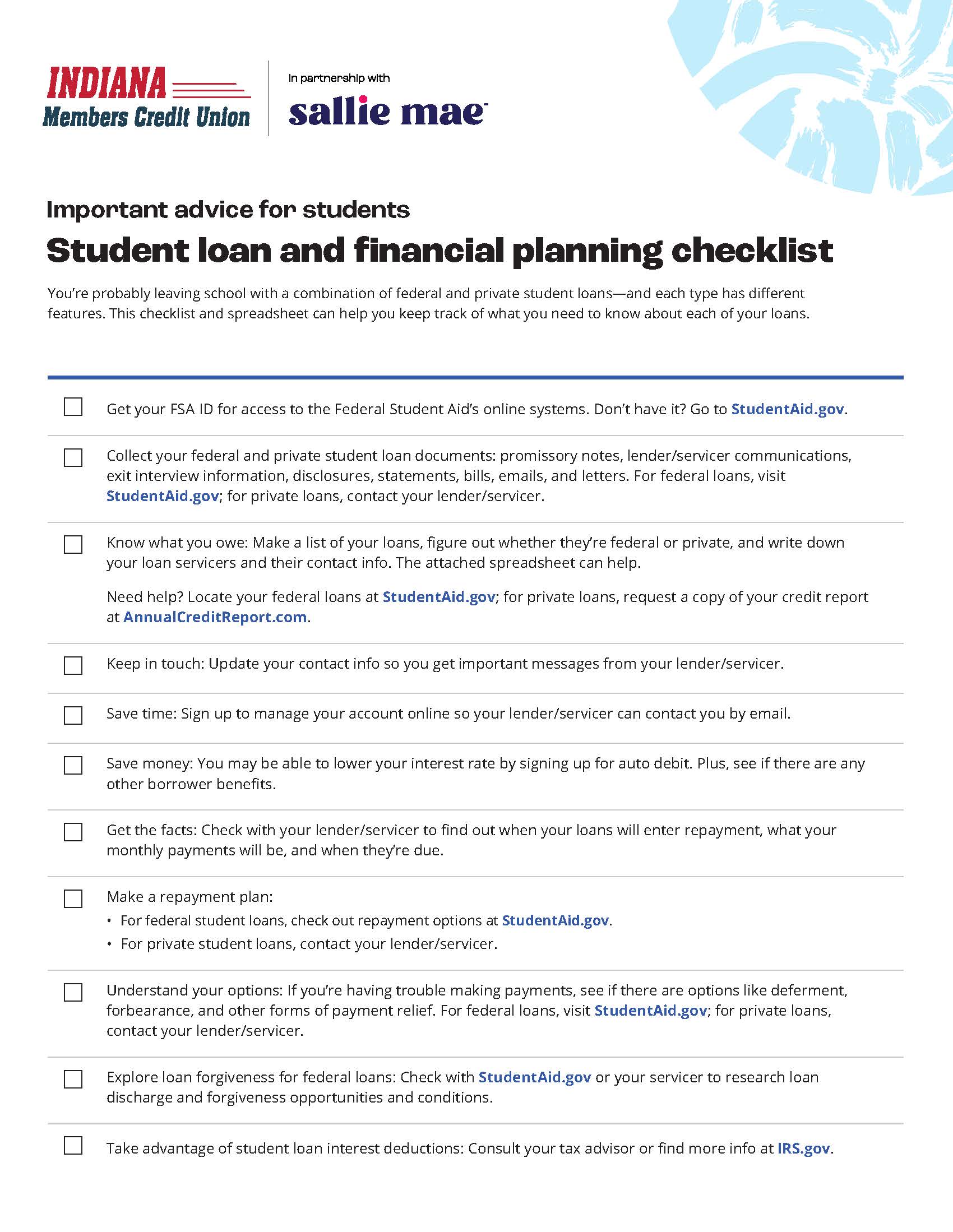

We encourage students and families to start with savings, grants, scholarships and federal student loans to pay for college. Evaluate all anticipated monthly loan payments, and how much the student expects to earn in the future, before considering a private student loan.

These loan are made by Sallie Mae Bank. Indiana Members Credit Union is not the creditor for these loans and is compensated by Sallie Mae for the referral of loan customers.

Applications are subject to a requested minimum loan amount of $1,000. Current credit and other eligibility criteria apply. Click here for additional eligibility information about each product.

SALLIE MAE RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS, SERVICES, AND BENEFITS AT ANY TIME WITHOUT NOTICE.

©2025 – 2026 Sallie Mae Bank. All rights reserved. Sallie Mae, the Sallie Mae logo, and other Sallie Mae names and logos are service marks or registered service marks of Sallie Mae Bank. All other names and logos used are the trademarks or service marks of their respective owners. SLM Corporation and its subsidiaries, including Sallie Mae Bank, are not sponsored by or agencies of the United States of America.

.jpg)